Navigating travel supplier pricing in a dynamic landscape

Corporate Travel Management’s (CTM) 2023 Global Customer Survey indicated that one of our customers’ top learning opportunities for the year ahead is the triggers impacting air, hotel, and car rental pricing. Understanding how travel suppliers approach contract negotiations and factors that impact travel supplier pricing will be crucial for Travel Programme Managers.

After a two-year freeze, travel suppliers began actively renegotiating their corporate travel contracts in 2022. According to a 2023 Deloitte report,[1] some suppliers are pushing for higher rates, with hoteliers adopting a more assertive stance than airlines. Moreover, select European suppliers are exerting more pressure than their American counterparts. As travel buyers return to the negotiating table, they may seek to leverage their own buying power alongside their Travel Management Companies (TMC) to secure more competitive deals.

In this blog, CTM’s Global Partnerships team provides insights around the regions to help support and empower Travel Arrangers and Travel Programme Managers with the expertise and insights they need to design and deliver more effective travel programmes.

Factors driving airline market dynamics

The travel industry is in a constant state of evolution, and the pace of change accelerates due to a multitude of external influences. These influences range from global events, economic shifts, technological advancements, sustainability concerns and unforeseen circumstances such as pandemics – all of which have an impact on airlines and their operations.

CTM’s Chief Partnership Officer Global Air & GDS, John Balloch, advises companies that now is the perfect time to review their existing airline agreements. “In Australia, New Zealand and Asia, suppliers currently hold the upper hand in negotiations, with airlines aiming for sizeable market share target agreements. However, deeper discounts may be available for companies that can achieve beyond those targets, with some airlines even offering a travel fund or incentive for spend over their market share agreement.

“In North America and Europe, airlines are reassessing their corporate strategies. With volumes not yet returning to 2019 levels, some airlines are reducing discounts and cutting extras, such as status upgrades and other soft dollar ancillaries.”

Penny Munn, CTM’s Chief Partnership Officer, UK and Europe, points out that a shift in buying behaviour is occurring in Europe. Some corporate customers are reverting to last-minute reservations. Consequently, some airlines are reintroducing last-minute availability for lower-class fares coming back to the market, but ultimately airlines are holding for the higher-class fares.

Balloch continues, “It’s also worth noting that there are attractive discounts on the Best Fare of the Day (BFOD), which can compete favourably against market share agreements. So, it may be worth considering adopting an open skies policy if you haven’t already done so.”

In Latin America, Rafael Gonzalez, CTM’s Vice President, Agency Partnerships Programme, says “Travel volumes remain stagnant at around -25% of pre-pandemic levels, with airlines now holding significant negotiating power through reduced rebates and corporate discounts lower than those before 2020. Meanwhile, in Africa, the corporate travel sector is experiencing a steady resurgence, demonstrating year-on-year growth. This trend is primarily driven by the continued dominance of airlines, as road, rail, and water transportation systems in the region are still in their early stages of development.”

Understanding the hotel landscape and rate trends in travel supplier pricing

For some markets, STR reports[2] that the 2023 Average Daily Rate (ADR) for hotels has increased due to strong performance and currency impacts. In North America, hourly earnings in the hospitality sector are over 22% higher than in 2019, surpassing the average increase in other private-sector industries. Similarly, during Q2 2022, wages in Europe’s accommodation sector were 14.9% higher than in the same quarter in 2019, outpacing wage inflation in other sectors. As the hotel industry recovers, these increased staffing costs and operational costs, in addition to demand, contribute to higher rates. This trend is expected to continue into 2024, however not at the scale witnessed in 2023.

When it comes to hotel contracting, Erik Shor, CTM’s Chief Partnerships Officer North America & Global Hotels, explains it depends on the market. “Many traditional business-centric markets and others that struggled the most during the pandemic, now find themselves with full properties and a shortage of inventory. Those hoteliers hold the power at the negotiation table. Other markets that rebounded early continue to experience strong demand due to their wide-ranging appeal with business-transient, leisure and meetings travellers. They too will try to push price increases.

Munn adds, “Some regions, such as the UK, have witnessed hybrid working patterns impact availability with Tuesday and Wednesday nights seeing demand outgrowing availability. Additionally, there’s a high demand for meetings and events, resulting in some suppliers increasing rates.” According to STR[3] the average daily rate in London was £208.51 in September, which was an increase of 2.6% compared to September 2022.

However, Shor says, “There are plenty of markets where hoteliers are seeing demand, occupancy and revenue per available room (RevPar) trend down year-on-year. As an example, cities like Minneapolis, Detroit, Houston, and Tuscon are seeing occupancy and RevPar rates under pressure. In these markets, savvy buyers may see rates hold steady or even decrease. Overall, there’s no one trend to hang onto; it’s very city-specific.”

In Africa, Gonzalez explains, “Global hotel chains continue to dominate the corporate travel landscape. They have a focus on dynamic pricing, creating challenges for our Travel Programme Managers when negotiating rates from a regional African perspective. In contrast, local African properties offer great flexibility in travel supplier pricing and check-in/out timings. However, their drawback lies in their absence from international booking portals, affecting the visibility of travel spend and traveller risk and safety.

“Meanwhile, Latin America faced a slower post-pandemic recovery, witnessing numerous property closures. Only now are these establishments gradually reopening and rebuilding their staffing levels. This reduced availability has led to higher rates, but we anticipate improvement as we progress into 2024.”

Car rental regional insights and considerations

The car rental market is recovering and adapting to customer preferences and demand, shifting operational strategies, adapting to new market dynamics, incorporating technology-driven solutions, and reevaluating its fleet.

Australia, New Zealand & Asia

In Australia, New Zealand and Asia, Balloch explains “The supply of vehicles has vastly improved in the last year – except specialised vehicles which are harder to secure. This has led to increased competition among rental companies. As a result, rates are reaching their peak, allowing customers to enjoy deeper discounts and more favourable deals. This presents customers with an opportunity to reassess their car rental agreements, as larger fleets and greater discounts are there to be found.”

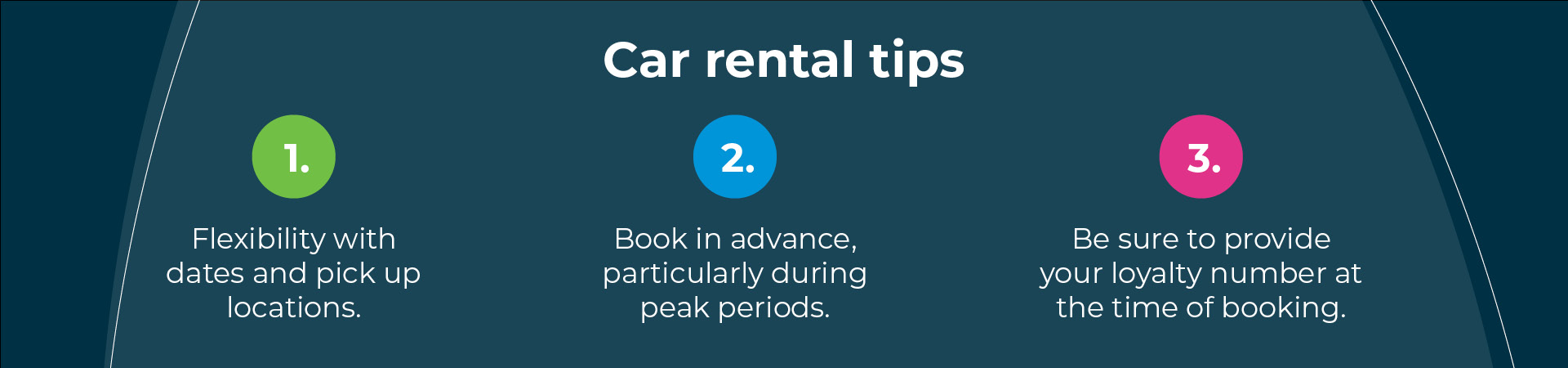

To optimise the car rental experience, Balloch suggests, “Flexibility in terms of dates and pick up locations is recommended as car delivery and collection costs can increase rates. Also booking in advance, particularly during peak periods or for specialty vehicles, is advised to secure favourable rates.”

North America

In North America it is a different story, Shor explains. “Supply remains a challenge for buyers and travellers in North America. Many car rental locations were unable to keep up with demand, as witnessed in the busy summer travel season. Travellers are encouraged to reference their loyalty number when the reservation is made. Loyalty members are experiencing far fewer service disruptions than those who are not members. Car rental companies have been successful in securing aggressive price increases even from their most loyal and large corporate customers.”

UK & Europe

The UK car rental market is experiencing notable shifts and improvements that are shaping its outlook. Munn says, “Some car rental businesses have taken significant steps to address previous fleet issues by extending the lease life of vehicles from the typical 6-month period to a potential 12-18 months. This strategic move effectively mitigates concerns related to fleet availability arising from UK manufacturing delays.

“This stands in contrast to other EU countries where rental locations remained operational. However, it is important to highlight that all EU locations are now fully operational, and business activities have resumed in full swing.

“In terms of pricing, car rental rates in the UK have now stabilised and are not expected to increase further as we move forward into 2024. This adjustment in pricing may contribute to increased affordability and attractiveness for customers. Overall, the UK car rental market is showing resilience and adaptability. These factors coupled with competitive pricing collectively shape a positive outlook.”

Value of working with a travel management company

Ultimately, the global travel landscape can be complex and challenging for customers to keep abreast of market trends and that is why working with a trusted TMC, like CTM that can leverage extensive buying power and negotiate the best corporate rates and inventory to ensure our customers are continually receiving value from their travel programmes.

You Might be Interested In…

To enhance your procurement strategy – read here to learn more about the unique aspects of travel procurement.

References

[1] Deloitte Insights – Navigating toward a new normal: 2023

[2] STR/TE Market Forecast Assumptions, 2023.

[3] STR London hotel performance growth moderated in September 2023.

Is it time to review your travel supplier pricing agreements?

Our team is ready to assist you today.